Crypto Wallets: What You Need to Know in 2022

![]() by Team Cryptoradar

by Team Cryptoradar

Updated: Sep 12, 2022

What is a crypto wallet?

Put in simple terms, a cryptocurrency wallet is a secure digital wallet that you can use to store, send and receive cryptocurrencies.

Cryptocurrency wallets are available in many different forms — on computers, smartphones, and even paper — and differ a lot in terms of security and features. For instance, there are wallets that can hold only one type of cryptocurrency, while others allow you to manage multiple digital assets. Some multi-currency wallets even let you convert one cryptocurrency into another, without moving your funds from your wallet to an exchange.

As you can see, there's no "one size fits all" when it comes to choosing a cryptocurrency wallet.

In this post, we will cover all major types of cryptocurrency wallets, including some advantages and disadvantages. But before we delve into these aspects, there are a few things you need to know.

How do crypto wallets work?

Public Key Cryptography

Cryptocurrency wallets are based on a cryptographic system called public key cryptography (also referred to as asymmetrical cryptography). This system uses a pair of "keys" — consisting of randomly picked characters — to encrypt and decrypt information. There are two types of keys: the private key is secret and only known by the key owner, and the public key is known publicly.

Blockchains, the technology most cryptocurrencies are based on, use this system to link each of its units with an owner. Bitcoin, for instance, associates each satoshi (the smallest available bitcoin unit worth 0.00000001 BTC) with an owner through a wallet address.

Wallet Address

Wallet addresses are like bank account numbers and are used publicly to store and transfer funds. They can be generated by a cryptocurrency wallet using the owner's public key.

A wallet address consists of a combination of numbers and letters, like this one: 3PTGoohUaVK7AQtzt4rXxuvkQBQfYEXgXG

In most cryptocurrencies, wallet addresses are transparent which means that you can easily find out how much money there is on a specific wallet. However, the real-world identity of the address owner is not revealed.

Private and Public Keys

While the public key is used to associate units of a cryptocurrency with an owner (usually through the wallet addresses), the secret private key is used to authenticate the owner's identity with the blockchain. This authentication is necessary to make changes on the blockchain, i.e. to send or receive cryptocurrencies.

The job of your wallet is to manage and safeguard your private and public keys. In essence, cryptocurrencies are not actually stored in your wallet — as you would expect it from a physical wallet with cash. Instead, units of a cryptocurrency only exist on the blockchain, but the wallet executes your control over your cryptocurrencies through your private and public keys.

Hence, it's very important that you do not lose your keys. Otherwise, you will lose access to your cryptocurrencies. Likewise, you must safeguard your keys from theft.

This is also why choosing the right cryptocurrency wallet is crucial. It determines where and how your private key is stored.

Using crypto wallets

There are many different kinds of cryptocurrency wallets which all have differences in how they are being setup and used.

Setting up a crypto wallet

Some wallets, especially those on the web, are set up only by providing a username and password.

Most wallets, however, will require you to setup private and public keys on first use. This is often done through a so called seed phrase (or recovery phrase). The seed phrase is a list of either 12, 18 or 24 words, like this one:

witch collapse practice feed shame open despair creek road again ice least

When setting up your wallet, you need to save and securely store your seed phrase. Your seed can be used to restore your wallet, e.g. if you lose your device.

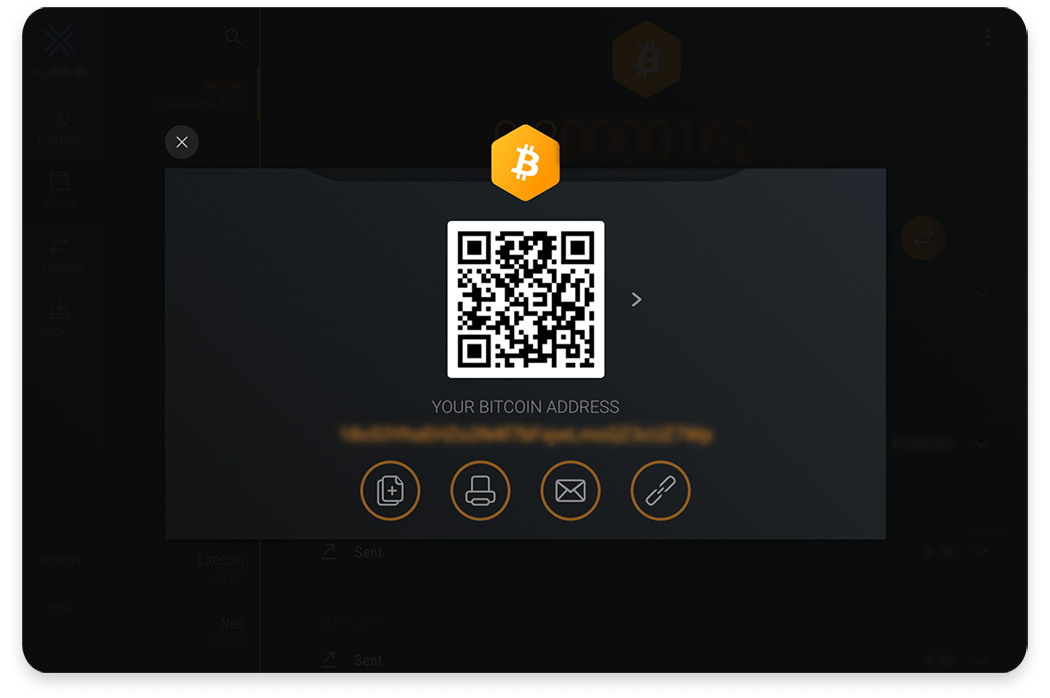

Receiving crypto

After setting up your wallet, it will be empty. In order to store and later on spend cryptocurrencies, you need to send them to your wallet. Your wallet should somewhere display a receive or deposit button. Simply click that button and you will be shown an address to send funds to.

Some wallets also offer QR codes which the sender can scan to automatically fill out the right wallet address. This makes it even more convenient to send and receive digital currencies.

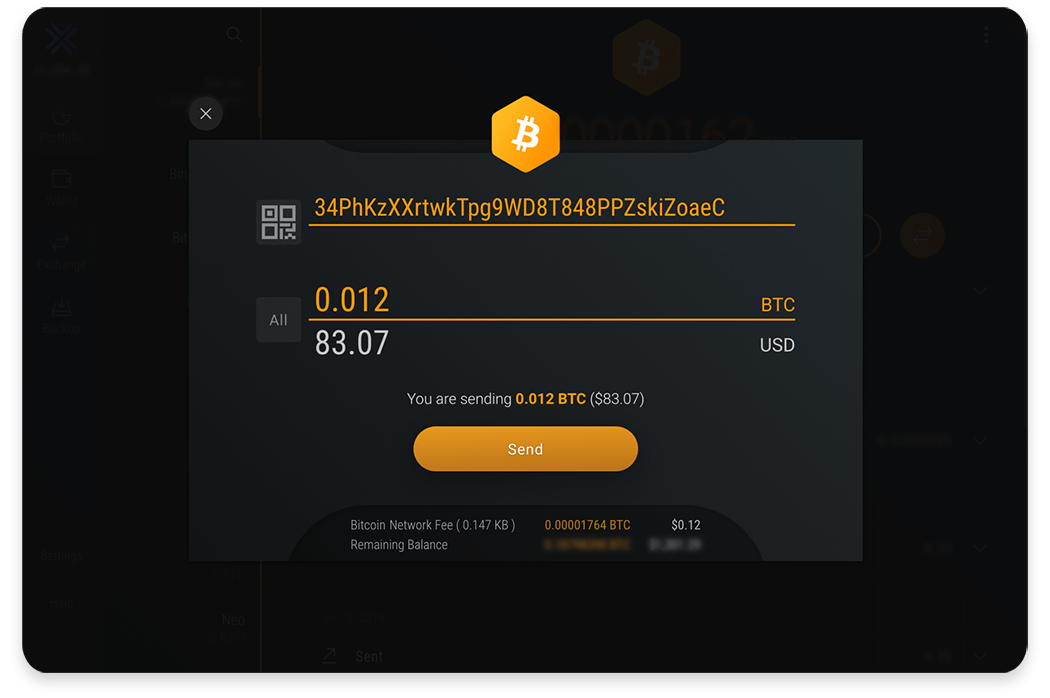

Sending crypto

Sending cryptocurrencies is just as easy as receiving them. Simply press the send or withdraw button, type in the wallet address of the receiver and confirm your transaction.

Different cryptocurrencies have different wallet addresses. Make sure to never send cryptocurrencies to a wallet address of another cryptocurrency. For instance, do no send bitcoin to an ethereum address!

Coin-specific Features

Some wallets also allow you to use currency-specific features.

For instance, some cryptocurrencies like Tezos offer a process called staking. By delegating Tezos tokens, you can earn an interest rate by lending out your coins to support the operations of the Tezos network.

Delegation is usually very easy to setup. All you need to do is to select a lender (also known as baker).

How secure are crypto wallets?

As you've learned by now, security plays a major role when choosing a cryptocurrency wallet. After all, an insecure or compromised wallet can have you loose your cryptocurrencies.

As soon as you are using a wallet that is connected to the internet, there will at least be a tiny chance that your wallet gets compromised. For instance, hackers may target you through malware, viruses or phishing.

Even the most secure technology is only as secure as the person handling it. Make sure to be alert to any dangers and protect yourself from any threats. Things you can do to improve the security of your cryptocurrency wallet include the following:

- Make sure that the passwords you use with your wallet are long and complex

- Only store small amounts of cryptocurrencies for daily use on web wallets (or exchanges)

- Keep your wallet up-to-date

- Backup your wallet regularly

- Run virus scans regularly

Hot and Cold Wallets

If you want to reduce the threat of getting hacked, there's another option. So far, we have only talked about wallets that are connected to the internet — so called hot storage wallets. By contrast, a cold storage wallet is created and kept off the internet for maximum security.

Cold storage wallets are usually hardware devices that look similar to an USB stick, but a cold wallet can even be as low-tech as a paper printout. We will cover more on this later.

Multisig Wallets

Another special form of cryptocurrency wallet is the multisig wallet (short for multisignature). What this means is that a multisig wallets requires transactions to be signed with private keys from multiple parties. Think of it like a joint crypto account shared by two or more individuals that requires every members’ private key to move funds from the wallet.

Multisig wallets are generally considered as more secure, because an hacker does not only need to compromise one private key, but several private keys which are usually stored on different devices.

Different Types of Cryptocurrency Wallets

There's a wide variety of different cryptocurrency wallets. In this article, we will introduce you to four main types:

- Web wallets

- Software wallets (desktop, mobile)

- Hardware wallets

- Paper wallets

Web Wallets

Can you trust a small tech startup to hold your life savings on your behalf? This is the question you need to ask yourself when using a web wallet.

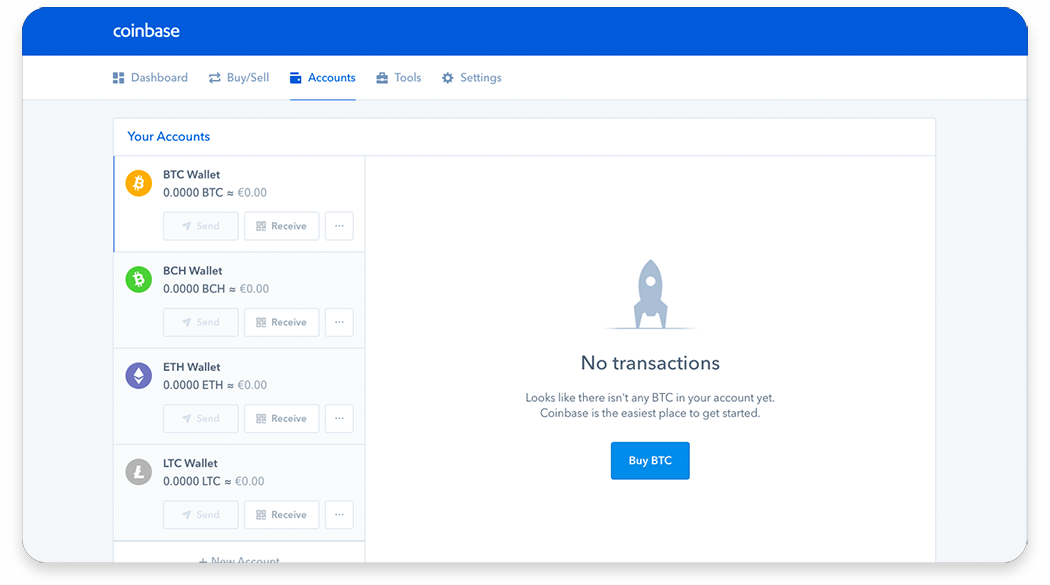

In brief, web wallets are either software wallets or a combination of software and hardware wallets that are accessible through a web platform. More specifically, there's web wallet platforms where you can setup an account and create your own cryptocurrency account.

Also many cryptocurrency exchanges offer web wallets alongside the purchase of cryptocurrencies.

The clear benefit of web wallets is that you can access your funds anytime through signing into the wallet provider's web platform. Some will even offer mobile or desktop apps linking your devices to their servers for even greater convenience.

However, since this service is offered in the cloud, web wallets are particularly targeted by hackers. Hence, you need to be careful before settling on a specific web wallet – they are notorious for being hacked and require additional layers of security such as two-factor-authentication.

We personally only store as much cryptocurrencies in a web wallet as we need in your everyday life for purchases or trading. For bigger investments we use more secure alternatives.

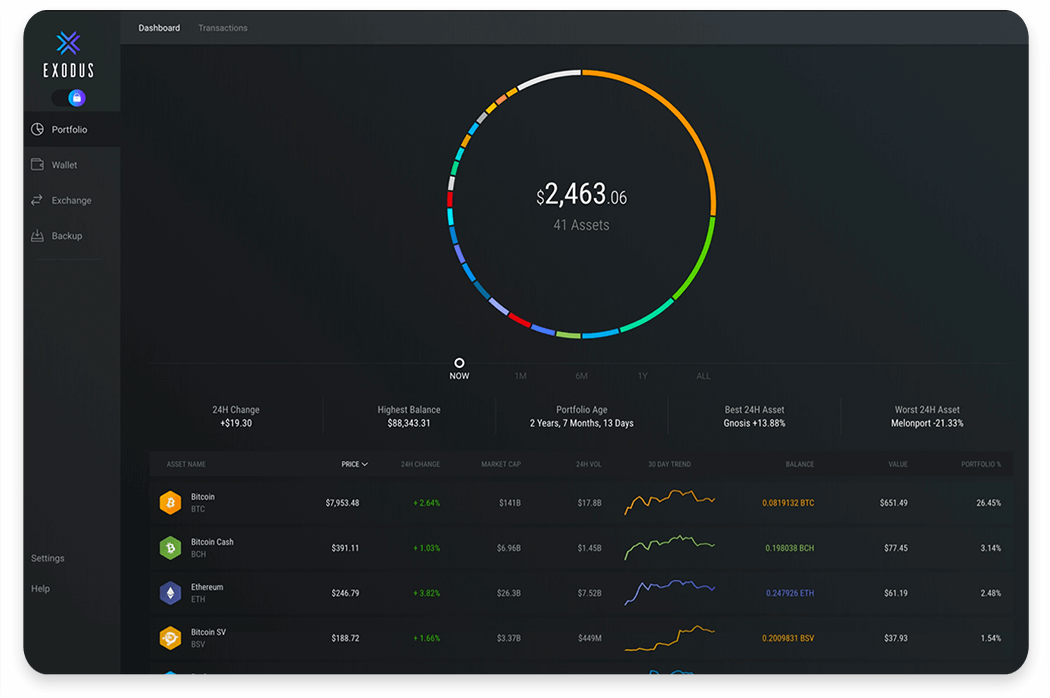

Desktop Wallets

Desktop wallets can be downloaded and installed as an application on a desktop or laptop computer, providing a central point of access to your cryptocurrency stash.

Desktop wallets usually store your private keys on your computer which means that you have full control (but also responsibility) over your investment.

As most computers are usually used to connect to the Internet, security may be compromised, since computers are susceptible to malware like viruses, spyware and adware. You, therefore, stand to lose the cryptocurrency stored in the desktop wallet if hackers gain access to your computer or should it be infected by malware.

When treated with care, desktop wallets are among the top picks as a cryptocurrency wallet, especially if you're just starting out. However, if you plan to make big, long-term investments, it may be sensible to invest into a cold storage wallet that is never connected to the Internet.

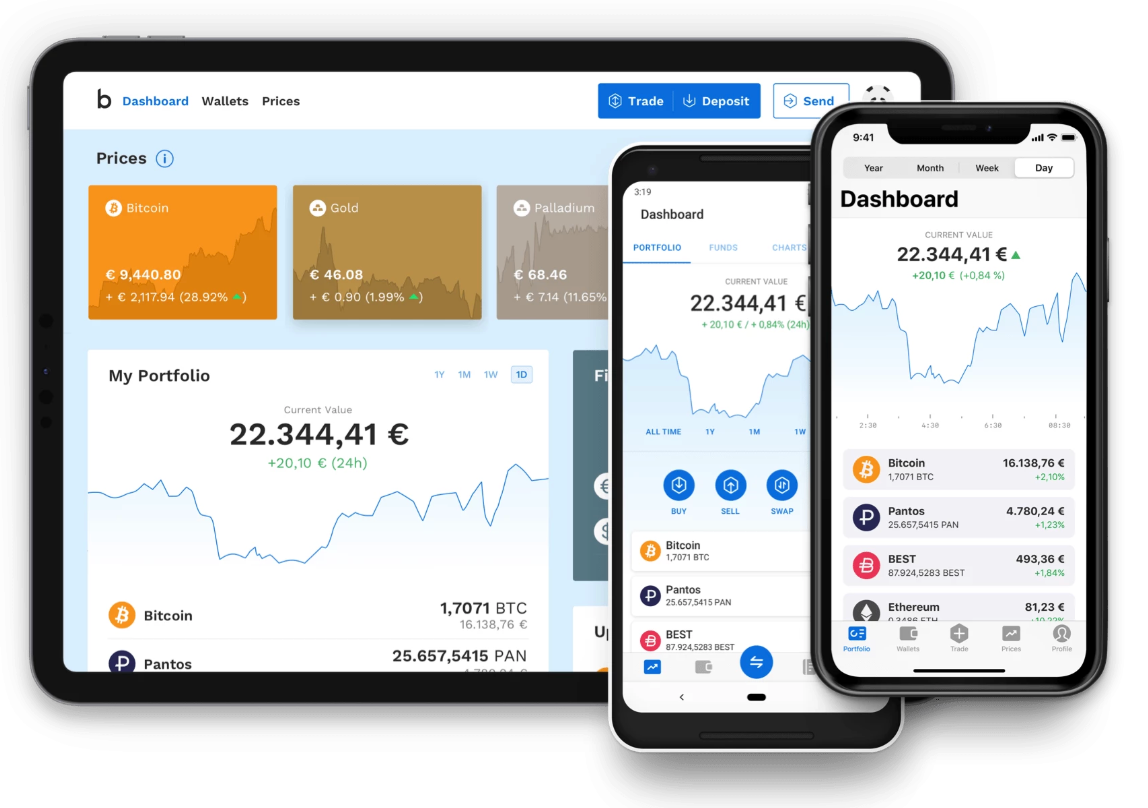

Mobile Wallets

Mobile wallets are smartphone apps that act as cryptocurrency wallets. Mobile wallets can be quite convenient for day-to-day use, since you have access to your cryptocurrencies while being on the move.

Need to quickly send some money to your friend or buy a coffee? A mobile wallet lets you make transactions fast and effortlessly. Mobile wallets often also offer great convenience, e.g. by offering the possibility to make transactions by scanning a QR code using your smartphone's camera, instead of typing or copy-pasting wallet addresses.

A big disadvantage of mobile wallets, however, is that there's often no way to export your private key. This increases the risk of losing your digital currencies, e.g. through theft or damage to you smartphone. Therefore, it's essential to regularly backup your smartphone.

Smartphones are also vulnerable to malware. This means that an attacker could potentially compromise your device and steal your funds.

Given the great convenience of mobile wallets, they can be used similarly to real wallets. Put a few bucks on them and you're ready to pay for goods and services on the go. However, we personally do not use a mobile wallet as our primary cryptocurrency wallet — just like we don't carry around all of the money we own in our real wallet.

Hardware Wallets

Just as the name suggests, hardware wallets are small devices specifically built to maintain the private and public key information of your cryptocurrencies.

To beginners, they probably look like USB-sticks, however, these devices are fitted with a screen, some buttons and come with special software applications that allow for a seamless connection to your computer.

Hardware wallets make up for a great combination of security and convenience, since they generally store your digital assets cold, meaning off the internet, while offering the possibility to be plugged into any internet connected device and complete transactions.

Nevertheless, also hardware wallets may not be 100% secure. Therefore, it is necessary to install all the updates provided by the wallet provider. We also strongly advise against buying hardware wallets through platforms like eBay, since there have been reports of cryptocurrency theft caused by manipulated devices. The most secure option is to buy directly from the manufacturer.

For big investments, a hardware wallet is our personal go-to solution. They are very secure, while still being relatively convenient and easy-to-use.

Paper Wallets

A paper wallet is literally a physical copy of your generated public and private keys printed piece of paper.

Paper wallets are considered among the safest methods for storing cryptocurrency off the internet. You can send or receive cryptocurrency by physically entering your private keys or by scanning the QR code that is usually included in the paper wallet print.

However, paper wallets are quite cumbersome to use. Furthermore, you must make sure to use a reliable generator, as there have been reports about fraudulent ones.

TL;DR: What’s the Best Cryptocurrency Wallet?

Whichever one you pick is a matter of personal preference, but before settling down on any of them, you should have a broad idea of how you intend to use your wallet.

- You can achieve this by asking yourself questions like:

- Do I need to access my cryptocurrency frequently?

- Do I need access to my wallet on the move or just at home?

- Do I need to store multiple digital assets or, for example, just bitcoins?

After you have made up your mind and assessed your requirements, you can go about deciding which wallet suits you best.

Your choice of a cryptocurrency wallet ultimately ties with the reason for embracing digital currencies. For instance, if you are investment motivated, you might want to consider settling with the more secure and long-term storage options like the hardware wallet. If, on the other hand, you hope to engage in crypto-related transactions often, go for storage options that allow for easy access to your currency, such as a desktop or mobile wallets.

Generally, there is no single right way to store your cryptocurrencies. You can also use a combination of multiple storage options to achieve your desired custody strategy. Regardless of the wallet you choose, backup your information regularly, make use of available security layers and always keep your wallet up to date.