Monero (XMR) Explained: What It Is and How It Works

![]() by The Cryptoradar Team

by The Cryptoradar Team

Updated: Aug 20, 2025

You want to buy Monero?

-

Compare 50+ exchanges

-

Read reviews

-

Find the best price

If you were to try on clothes in a clothes shop, the only way the staff could be certain you weren’t stealing would be to make you try on the clothes in public. They wouldn’t need to trust that you weren’t stealing because they, their CCTV and their other customers could all hold you accountable if they saw you doing anything suspect.

Many cryptocurrencies operate a similar system. Every transaction is recorded on a public ledger that can be viewed by any users. This has many benefits. It (combined with the use of cryptography) ensures that transactions are almost impossible to be counterfeited or duplicated. And by allowing users to validate transactions on a majority basis, the currency is unlikely to be compromised by a third party. This is much more secure than in the real world where a 4-digit pin (guessable, observable and hackable) or a security tag (removable) are used to protect products and currency.

However, this transparency begs some questions surrounding privacy. While you probably haven’t experienced it for yourself, I’m sure you can imagine that trying on clothes in the middle of H&M on a busy Saturday afternoon wouldn’t be the most pleasant experience. While it might be a more secure option for the retailer, it is not the most comfortable, safe or private option for the consumer.

From changing rooms to voting booths, Facebook passwords to padlocked diaries, we appreciate, require and expect a certain degree of privacy in the real world, so it’s not ridiculous to expect the same in the crypto-world.

Those who are familiar with cryptocurrencies like Bitcoin may argue that crypto-transactions don’t directly link to a personal identity. However, there are a growing number of ways to connect public keys to personal identities, including blockchain analysis and know your customer policies. To labour the exhausted shopping metaphor just a little more, this is the crypto-equivalent of blurring out a face on CCTV. It provides some anonymity, but it isn’t foolproof.

What is Monero?

Enter Monero. Monero is an open-source cryptocurrency that prides itself on privacy, so much so that only two of its seven founders are known to the public. While Monero relies of the same underlying technology like other cryptocurrencies, the so called blockchain, the founders of Monero recognised Bitcoin’s flimsy privacy procedures and set out to better them.

The realms of ‘privacy’ are often considered to be quite shady, but there are plenty of non-shady reasons you might want privacy. Perhaps you’re in business negotiations and you don’t want to reveal how much you can afford. Perhaps you don’t trust your country’s government. Perhaps you don’t want to expose yourself as a promising target for criminals. Perhaps you don’t want your mum to see how frequently you’re buying takeaway pizza. Privacy is a fundamental human right.

While analogies of public nudity and pizza orders might be entertaining, they can’t divulge the technicalities of how Monero has secured such privacy and why it is so important. Achieving privacy while maintaining decentralised transparency is by no means a straightforward matter, so it’s time to ditch the metaphors and delve into the technicalities.

What Makes Monero Special?

Ring Signatures

One of the ways that Monero achieves their optimum privacy is their adoption of ring signature technology. This means that when a transaction is made, the real signer is accompanied by a number of decoy signers that Monero call mixins. Mixins are actually past transaction outputs that are ‘mixed in’ to the transaction to protect the privacy of the sender. This means it would be impossible to determine which signer is the actual signer, keeping the original input a secret and giving the signer plausible deniability.

While this sounds private, it doesn’t sound particularly easy to validate which compromises its security... But fret not, Monero has covered that too. Monero uses key images to ensure that users can’t double spend. Key images are used with every transaction and while there may be eight signatures in a ring signature, there is only one key image. These key images are recorded on the blockchain so miners can continue to verify transactions.

Stealth Addresses to Buy Monero

While ring signatures ensure the sender’s privacy, stealth addresses protect the receiver’s. Even if one user repeatedly sends Monero (XMR) to a particular address, it will appear on the blockchain as a different address each time. Stealth addresses are essentially randomised one-time addresses so the sender and receiver are the only two users who really know where the Monero was sent.

RingCT

So, you can’t work out the identity of the receiver, you can’t work out the identity of the sender, all that’s left to cover up is the value of the transaction. This is where ringCT technology comes in. A relatively new addition to Monero’s offering, ringCT stands for ring confidential transactions. This technology doesn’t encrypt the information but instead encodes it to obfuscate the transaction value. The miners can simply see that the input equals the sum of the output so it can still be validated.

Advantages of Monero

Fungibility

Monero’s privacy features are even beneficial for those who don’t consider privacy a priority.

When you hold a banknote in your hand, you do not know where it’s been or what it’s been used for. You have no way of telling if it has been used to buy toilet rolls and custard creams or crack cocaine and body parts. This unidentifiable record means that a banknote’s past cannot influence or change a banknote’s value, it will continue being worth the denomination stated on the note. It is fungible, meaning it is interchangeable with another note of the same denomination.

However, for most cryptocurrencies, every transaction is detailed on a public ledger so users can see exactly where the currency has been ever since it first came into crypto-existence. This means that if the currency was once tied up in criminal transactions then this is trackable and may well tarnish its value. It is not fungible. At risk of sounding like the American declaration of independence, all coins may be created equal, but ten years later it is likely they won’t be equal at all!

However, because of Monero’s solid privacy features, Monero is a cryptocurrency that is fungible. As you can’t track the coins’ history, you have no way of working out whether it’s clean or dirty. While this does help some criminals, it also helps innocent users who might inadvertently come to possess tarnished currency.

Decentralisation

While Monero is famed and celebrated for its privacy, it’s mining process is also noteworthy.

Mining involves users decrypting transactions to validate them and, in return, earn themselves extra currency. This is a big component of how cryptocurrencies can be decentralised as the majority of miners need to agree on a calculation for it to be valid and, technically, anyone can be a miner.

However, many cryptocurrencies require or favour an ASIC, a specifically designed integrated circuit. ASICs can be incredibly expensive and they require a lot of electricity. Because of this, mining is either dominated by those in countries with cheap electricity, by those who can afford the best ASIC, or by those who combine their computational power in a mining pool. All of these dominators make cryptocurrencies more centralised than they were hoped to be. Morally, this is problematic but it could also cause security problems. If a pool was to own more than 50% of a blockchain then they could halt, reverse or redirect transactions.

Instead, Monero is ASIC-resistant, favouring more accessible CPU mining. The hope is that this will ensure miners are more evenly distributed and autonomous. While Monero’s ASIC-resistance is promising, it is not yet completely successful. It is thought that 43% of the hash rate is controlled by three pools.

How to use Monero?

Wallets

After drowning in Monero’s quite technical jargon, the familiarity of ‘wallets’ is probably a welcome change. Wallets are like…. well, wallets. In retrospect, perhaps keyring might have been a more appropriate term as a crypto-wallet does not store currency, just the keys that access the currency. But if you’re familiar with cryptocurrencies, you will know that ‘wallets’ is a term used across most currencies.

Because of Monero’s highly private nature, there aren’t as many wallets around for Monero as there are for other cryptocurrencies. Most wallets only have to hold two keys: a private key and a public key. When it comes to Monero, your wallet needs to hold a public view key, a public spend key, a private view key and a private spend key. Despite this complication, worry not, you still do have wallet options.

You need to trust your wallet. You could opt for a hot wallet where your key is stored online, but if you’re buying Monero then you’re probably interested in privacy and security, so this might not be your best option. Instead, a cold wallet, a wallet stored on a piece of hardware, is typically the way to go.

Making Transactions

While privacy is important, Monero recognises that their optimum, no-nonsense approach to privacy is not always necessary. Privacy is not a one-size-fits-all situation, so some of Monero’s privacy features can be personalised. When a transaction is made, users can specify how big they want the size of the ring signature to be. The bigger it is, the more indecipherable it will be. This means the Monero you transfer for a haircut needn’t have the same privacy bells and whistles as a six-figure investment… unless you want it to…

How to Buy Monero

Monero has been around quite some time... since 2014 actually. Yet, it's so different to most other cryptocurrencies that it can only be purchased on a select few platforms.

If you want to get a hold on Monero, simply follow these three steps:

- Find a cryptocurrency exchange

- Sign up for a cryptocurrency exchange

- Buy Monero using US dollars or euros

Find a Monero exchange

There are hundreds of cryptocurrency exchanges, so how should you decide which one to use?

The first thing you should pay attention to is security and trust. Since you're planning to buy a privacy-focussed cryptocurrency, this probably goes without saying. Cryptocurrency exchanges offer different levels of security, but, generally speaking, security features like 2-factor-authentication and cold storage should be a minimum requirement.

Another important aspect is user experience. Especially if you're new to crypto, you want to be able to not only buy Monero securely, but easily. An intuitive user interface also helps you make better informed decisions, avoiding mistakes.

However, high security and great user experience often come at a cost. It's more expensive to be best-at-all, therefore, many easy-to-use platforms charge higher prices and fees. Transaction costs can range anywhere from 0,1% to more than 10% depending on the platform and your mode of payment.

How to use Cryptoradar to find a cryptocurrency exchange

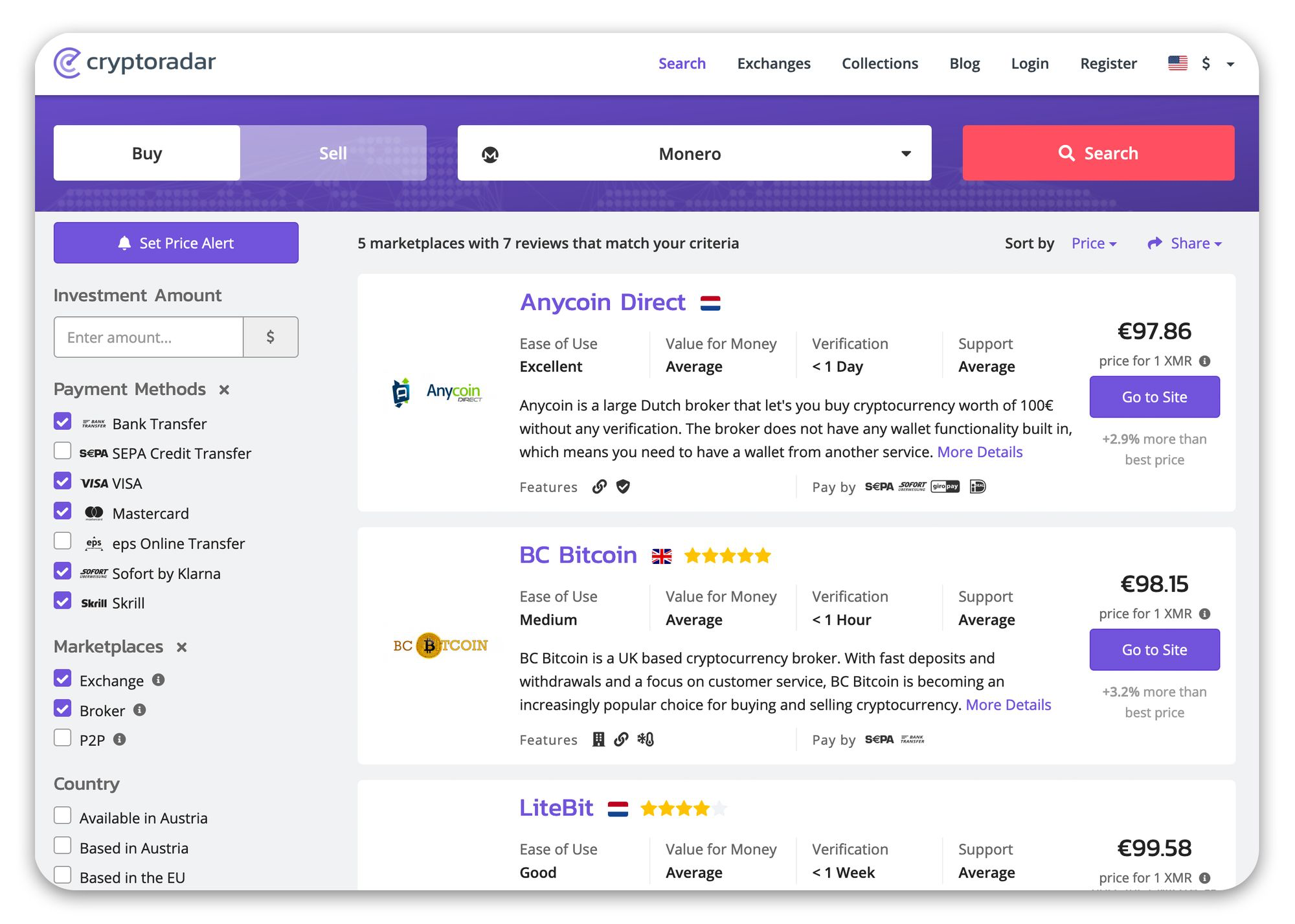

Cryptoradar helps you find a cryptocurrency marketplace, providing you a comprehensive yet compact overview Monero marketplaces.

Currently, there are around half a dozen cryptocurrency exchanges listed that have Monero on offer.

By default, exchanges on Cryptoradar are sorted by price, which always gives you the cheapest option for buying cryptocurrencies. The listings also provide you a quick overview of important factors to consider, such as ease-of-use, verification times and fee structure. Use the filters in the sidebar to amend your criteria.

Sign up for a Monero exchange

Signing up for a Monero exchange probably is a fairly simple process. Just enter your details like on any other exchange. Before you're good to go, however, most platforms ask you to verify your identity to fulfill their anti-money-laundering obligations. This often is as easy as uploading a scan of your passport.

Buy Monero using US dollars or euros

Finally, you're there! And no kidding - the actual process of buying Monero is actually the easiest part of the whole process.

The last step towards buying Monero is to send money to the exchange. This can be done using bank transfer, and often also with credit card, Skrill or other payment methods.

Once your payment is received by the cryptocurrency marketplace, you can finally go ahead and buy Monero. On most marketplaces it’s as easy as selecting the purchase amount (in US dollars or euros) and clicking the buy button.

After your purchase, it's recommended that you send your shiny, new Monero to your own wallet. You can read up more on this in our cryptocurrency wallet guide.

The Long and Short of It

More and more cryptocurrencies are recognising the importance of privacy, attaching new features and functions to compete with Monero’s offering. But crucially, Monero includes these functions in every transaction. This is a coin that holds privacy at its core rather than grappling for it as an afterthought. In an increasingly scrutinised world, that’s considered pretty valuable.