Best Crypto Tax Software in 2026

![]() by The Cryptoradar Team

by The Cryptoradar Team

Updated: Feb 24, 2026

Tax season can be a headache for any investor, but for crypto traders, it’s a whole new ballgame. With the complexities of tracking transactions across multiple exchanges and wallets, calculating your crypto tax liability can quickly become overwhelming. But don’t worry — there’s software out there designed to make the process smoother and more accurate than ever before. In this article, we’ll dive into the best crypto tax calculation tools on the market, helping you find the right one to keep your crypto earnings on the right side of the law. Ready to take the stress out of tax season? Let’s get started!

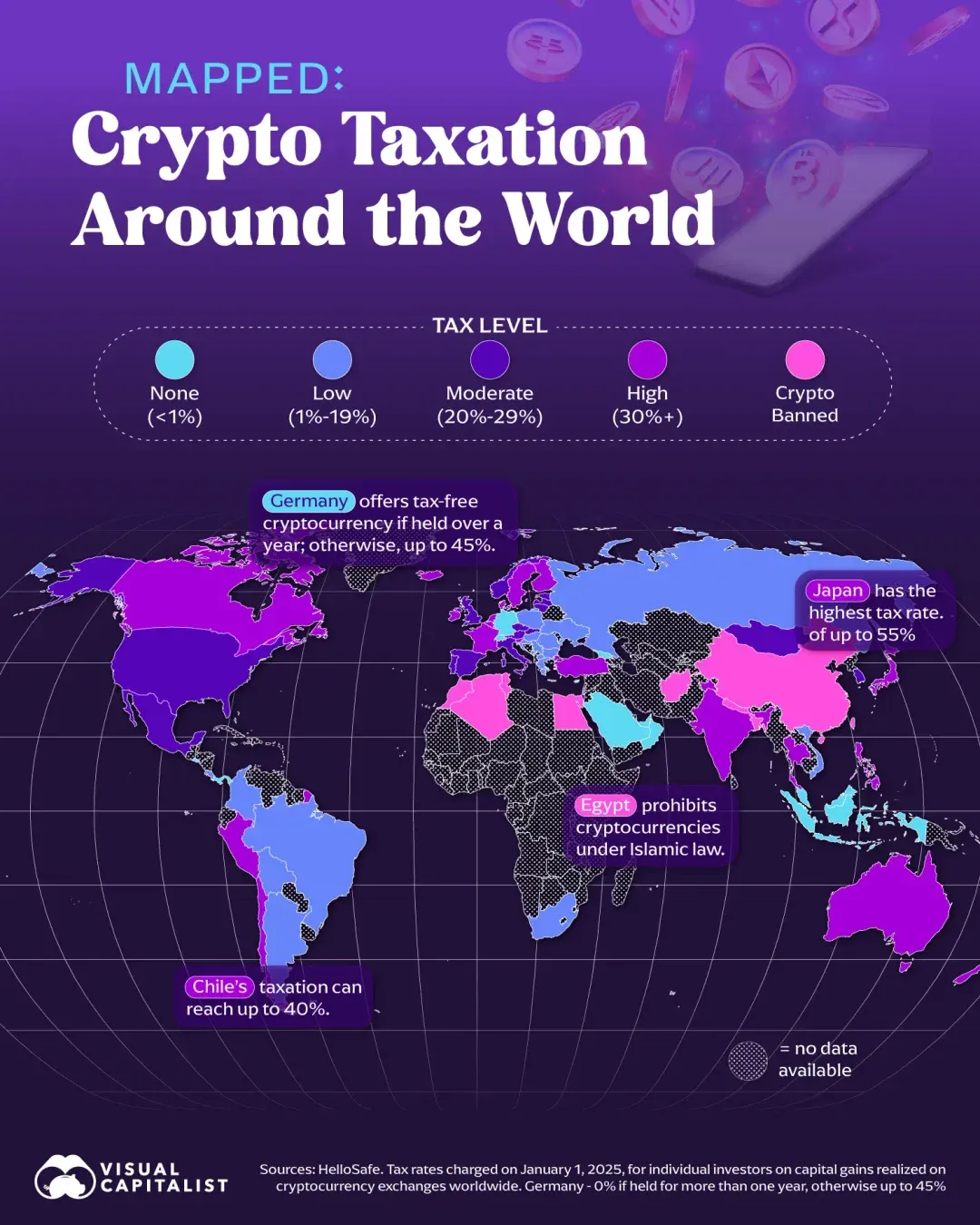

The Global Crypto Tax Landscape

If you're trading or investing in crypto, where you live can make a massive difference in how much you owe in taxes. In Japan, crypto profits can be taxed as high as 55%, while Denmark isn't far behind, with rates reaching up to 52% depending on income. Meanwhile, Germany offers a sweet deal - hold your crypto for more than a year, and it becomes completely tax-free; otherwise, expect rates of up to 45%.

On the flip side, some countries, like Switzerland, the UAE, and El Salvador, don’t tax crypto at all, making them attractive hubs for investors. If a country’s crypto tax laws seem unclear, it’s often because regulations are still evolving - meaning surprises could be just around the corner.

Therefore, it makes sense to use a crypto portfolio tracker and crypto tax calculator software, even before you sell you coins. Crypto tax software can help you find out your tax obligations and even optimize your tax bill, e.g. through tax loss harvesting or tax-privileged sales.

Crypto Tax Software Comparison Matrix

Crypto tax software makes it so much easier to follow the local tax regulation in your country. Therefore, we compiled a list of five of the most well-known tools that help you file your taxes (In-depth reviews below table.)

| Feature | SUMM | Koinly | CoinTracker | Blockpit | CoinTracking |

|---|---|---|---|---|---|

| Rating | ★★★★ | ★★★★★ | ★★★★ | ★★★ | ★★ |

| Value | ★★★ | ★★★★ | ★★★ | ★★★ | ★★★ |

| Accounting Methods | FIFO, LIFO, country-specific methods (jurisdiction dependent) | FIFO, LIFO, HIFO, ACB (Canada), Share Pool (UK) | FIFO, LIFO, HIFO, ACB (Canada), Share Pool (UK) | FIFO | FIFO, LIFO, HIFO, ACB (Canada), Share Pool (UK) |

| Dashboards | Portfolio overview, Tax position views, Reconciliation dashboard, DeFi & NFT activity views | Account Performance, Crypto Pie Chart, Accounting Journal (double-entry ledger), Margin Trading Report | Account Performance, Crypto Pie Chart, Accounting Journal, Tax loss harvesting | Account Performance, Crypto Pie Chart, Accounting Journal | Account Performance, Crypto Pie Chart, Accounting Journal (double-entry ledger), Tax loss harvesting, Realized & Unrealized Gains, Tax-privileged coins (holding period) |

| Tax-privileged coins | No (jurisdiction logic only) | No | No | No | Yes |

| Data Import | 3,500+ integrations (CEX, DEX, chains, DeFi), Wallet import, CSV | Exchange API, Wallet API, Wallet Address, CSV | Exchange API, Wallet API, Wallet Address, "Cointracker CSV" (reformatting required) | Exchange API, Wallet API, Wallet Address, CSV | Exchange API, Wallet API, Wallet Address, CSV |

| Supported APIs | ★★★★★ (3,500+ integrations) | ★★★★★ | ★★★ | ★★ | ★★★★ |

| Data Export | Downloadable tax reports, capital gains, income summaries, audit trails | TurboTax, TaxACT, Drake, H&R Block, SteuerGo, WunderTax, Taxfix | TurboTAX, TaxACT | - | TurboTax, TaxACT, Drake, WISO Steuer |

| Mobile App | No (web app only) | Yes | Yes | Yes | Yes |

| Staking | Yes | Yes | Yes | Yes | Yes |

| Margin Trading | Yes | Yes | Yes | Yes | Yes |

| Futures & Derivatives | Yes | Yes | No | No | Yes |

| Helpdesk | ★★★★ (in-app chat, email, priority support on paid plans) | ★★★★★ | ★★★★★ | ★★★★ | ★★★ |

| Design & UX | ★★★★★ | ★★★ | ★★★★ | ★★★★ | ★ |

| Pricing | Most popular tier: Investor at $249/year (10k trx) | $179/year (3k trx) | $199/year (1k trx) | $199/year for (25k trx) | $132/year (3.5k trx) |

| Link | Try It Here | Try It Here | Try It Here | Try It Here | Try It Here |

Zooming in

SUMM

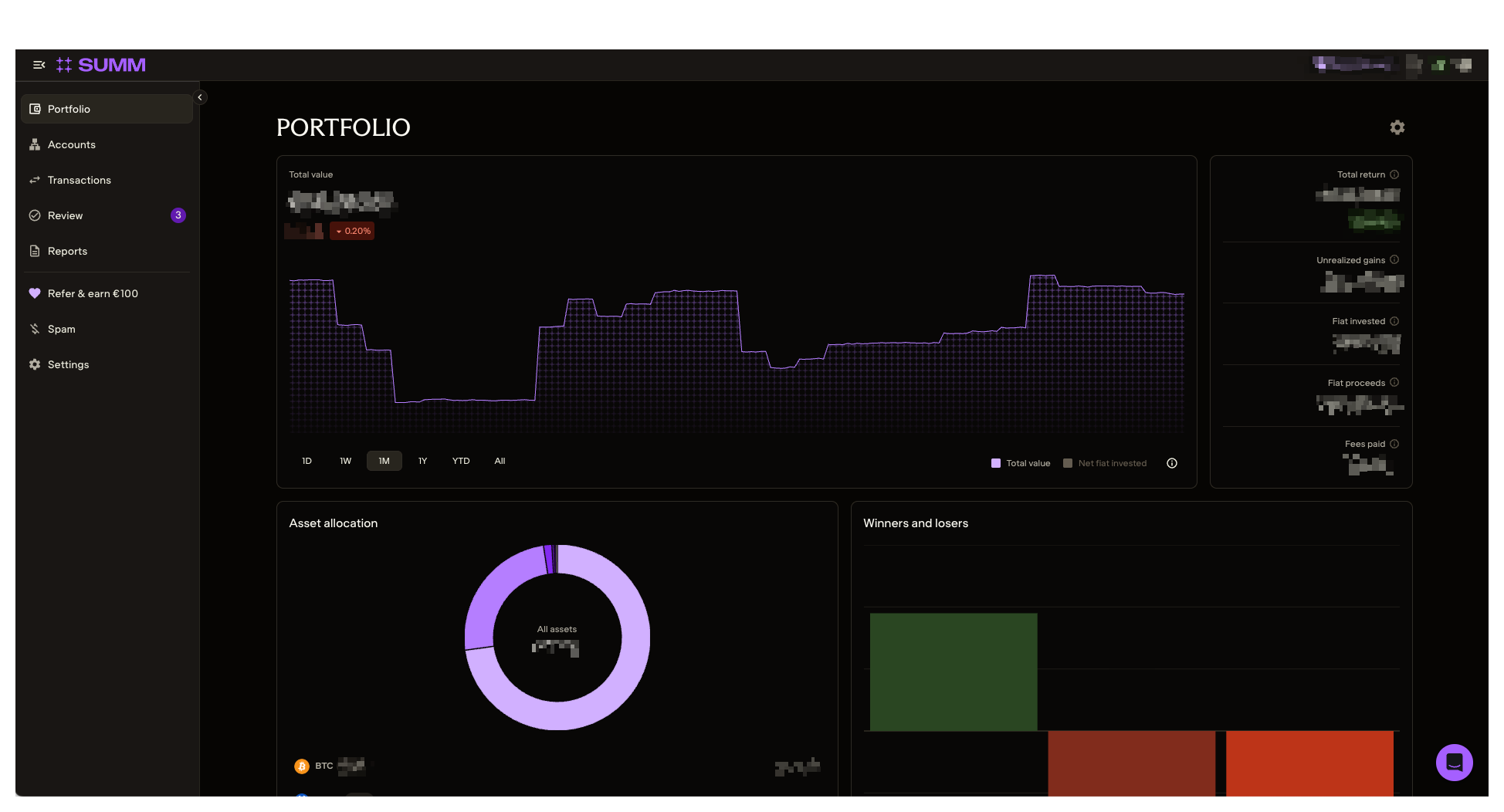

Summ is a crypto tax software originally launched as Crypto Tax Calculator and later rebranded to Summ as it expanded globally and moved up‑market toward more professional‑grade reporting. The rebrand reflects a broader focus on precise tax calculations, deeper DeFi support, and collaboration with accountants rather than just being a simple retail calculator. Today, Summ positions itself as an “IRS‑ready” and multi‑jurisdiction tool, supporting thousands of exchanges, wallets, and DeFi protocols under a unified interface.

On the plus side, Summ is strong in complex use cases: it handles DeFi, NFTs, staking, and derivatives, supports multiple cost‑basis methods, and offers detailed reconciliation views so you can fix problematic transactions one by one. Its large integration catalogue and audit‑friendly reports make it attractive for heavy traders and those who work with accountants. On the downside, pricing scales with transaction volume and can get expensive for very active users, and there is no dedicated mobile app.

Summ is best suited for advanced users: active traders, DeFi/NFT power‑users, and professionals who need robust audit trails and flexible accounting methods rather than a basic one‑exchange calculator. It’s a strong choice for people with multi‑exchange, multi‑chain portfolios (including margin and futures) who want granular control over their data and are willing to pay for high‑end reporting. Casual buy‑and‑hold investors with a small number of simple transactions may find lighter, cheaper tools sufficient, but once you cross into complex on‑chain activity, Summ becomes one of the more compelling options.

Koinly

Founded in 2018, Koinly convinces with a well-designed user interface and dashboard and support for all major accounting methods and markets (35+ countries).

What makes Koinly truly stand out is its massive API support, be it for importing transactions from exchanges and wallets, or for exporting tax reports to more than five different tax apps like TurboTax.

One of the biggest downsides of Koinly is the lack of some more advanced reports like tax loss harvesting and tax-privileged coins.

Koinly is one of the more expensive crypto tax softwares in our review. On the plus side, you only need to pay the annual fee with Koinly when creating tax reports. So, if you're only interested in tracking your investments, Koinly will be free-of-charge for you.

Blockpit

Blockpit is an Austrian-based service that is mainly focused towards the German-speaking markets and recently started a cooperation with Bitpanda, the leading crypto exchange in these countries.

Being still in earlier stages of development, the crypto tax software of Blockpit falls short in many aspects compared to more established providers. While the minimal user interface is very well designed and the platform is very pleasant to use, it lacks certain accounting methods and several reports such as tax loss harvesting and tax-privileged coins. It also only offers very few integrations, making data imports from smaller exchanges a hassle. Trading of crypto derivates and futures is currently not supported. There are also no data export capabilities for tax software like TurboTax.

Given the lack of these important features for professional users, Blockpit is best suited for smaller, long-term investors, who are users of one of the supported exchanges.

Given this focus of the platform, the pricing of Blockpit is somewhat irritating to us, with the cheapest paid plan starting at 25k transactions – an amount that only frequent traders require. In our opinion, the crypto tax software could really set itself apart from its competition, if it offered a cheaper plan for smaller investors (e.g. with up to 1k transactions) at a price point below $100.

CoinTracker

CoinTracker is a San Francisco-based crypto tax software company primarily serving English-language markets.

The platform supports key accounting methods, including ACB for Canada and Share Pool for the UK, making it a viable option for users in these regions. Transactions can be imported via exchange APIs, wallet APIs, wallet addresses, and CSV files. However, API support for exchanges remains somewhat limited, which means users may need to rely on CSV imports — often requiring careful formatting to ensure accuracy.

CoinTracker’s user interface is generally well-designed and modern, though some elements feel a bit over-engineered. For example, the top navigation bar contains only four items, yet some dropdowns include as few as two options, which could be streamlined for better usability.

In terms of features, CoinTracker covers most essential functions expected from a crypto tax and portfolio tracking tool. It also offers direct integration with TurboTax and TaxACT, which can be a time-saver during tax season. However, professional traders may find the lack of support for futures and derivatives trading limiting. Additionally, users in countries with specific tax rules — such as tax exemptions after a one-year holding period — may find alternatives like Koinly or CoinTracking better suited to their needs.

One of the main drawbacks of CoinTracker is its pricing. At $199 per year for up to 1,000 transactions, it is one of the most expensive options on the market, which may be a consideration for users with high transaction volumes.

Overall, CoinTracker is a solid choice for casual to intermediate crypto investors, particularly those in Canada, the UK, and the US. However, more advanced traders or those needing broader international tax rule support may want to explore other options.

CoinTracking

Founded in 2012, CoinTracking is probably one of the longest standing crypto portfolio trackers and tax apps there is.

Based in Munich, Germany, the company nowadays has a very international footprint, supporting almost all accounting methods and tax regulations you can think of. CoinTracking has also a wide language support, including all major languages and even smaller markets such as Polish or Catalan.

Transactions can be imported via one of more than 70 exchange and wallet integrations (via API), via wallet addresses and via CSV.

CoinTracking does not only support an abundance of countries and exchanges, but also offers the most advanced reporting capabilities. There is a report for almost everything, and you can export your tax reports directly in TurboTax, TaxACT and Drake.

Yet, this is where the drawbacks start. Sometimes, it's a bit hard to understand what the different reports are all about, how to create a valid report for your country, and what the charts actually mean. Additionally, the helpdesk is often not very actionable and only provides rather generic advice. It feels a bit as if a tax lawyer wrote the FAQs. Luckily, the support team is very responsive, which means that you can expect a reply to your question within one or two business hours.

As a result, CoinTracking has a comparably steep learning curve to fully understand. Even then, the user interface is still too complicated, and some actions like making changes to transactions will require much more time than with competing crypto tax tools.

Cointracking would easily be our preferred choice, if they were to solve these issues. Until then, it's a great tool for power users who really want to invest time and get the most out of their crypto portfolio tracker, but probably not the best option for less tech-savvy and inexperienced cryptocurrency investors.

Final Verdict

Crypto tax software is no one-size-fits-it-all. In the end, your decision will be dependent on your needs.

For instance, if you are based in markets with a tax-exemption rule after a certain holding period and prefer software that is easy to use, you will be best served with Koinly. If you can't care less about beautiful charts, but want all the power features there is, then CoinTracking is the better choice.

So, before making your decision, define your objectives and check if your exchanges and wallets are supported by the different tax tools. This way, you can make sure that the crypto tax software you select will be the right one for you.